Data Annotation Services for Streamlined Insurance Industry

The Label Your Data team provides expert data annotation services for the insurance industry to help our clients build AI-first insurance solutions.

contact us

We Scale Teams for:

Data Annotation for Insurance Industry at Label Your Data

We provide a wide range of customized data labeling services for insurance. Our expertise spans various projects, from annotating visual data like images of crashed cars, to working with textual data like insurance documentation or annotation techniques to build powerful NLP algorithms. Additionally, we can handle complex projects such as tagging images within vast customer databases.

These tasks can be both interesting and challenging due to the scale and complexity of the data annotation in insurance projects. Our ability to tackle these different cases sets us apart, allowing our annotators to deliver exceptional results for insurance companies. With over a decade of industry expertise, Label Your Data is dedicated to helping the clients optimize their operations through high-quality labeled data for AI in the insurance industry.

Our Data Annotation Services for Insurance Companies

Label Your Data offers top-tier data annotation services for the insurance industry. We maintain strict security and quality standards, ensuring the protection of sensitive insurance data. Our experts enable insurance firms to streamline risk assessment, fraud detection, claims processing, customer experience enhancement, and predictive analytics through AI.

For retail projects, we provide both Computer Vision and NLP data annotation for retail industry, with live teams handling various tasks, such as:

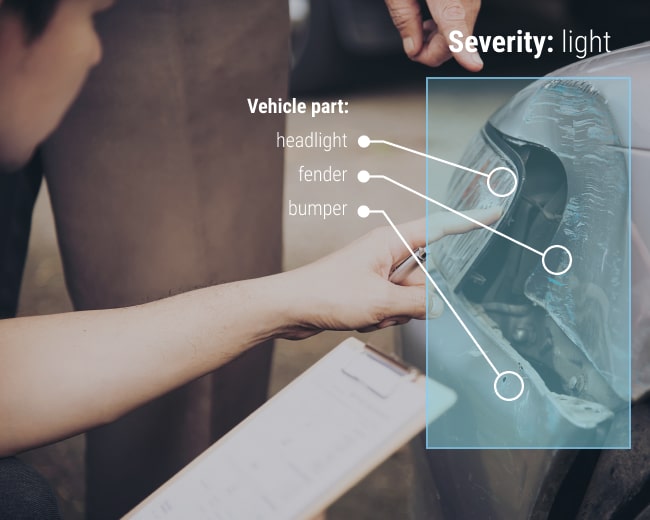

We employ image tagging techniques to assign relevant tags or labels to insurance-related images and categorize them. This helps in organizing and retrieving visual data efficiently.

Our team annotates images by drawing bounding boxes around specific objects or regions of interest. This technique aids in object detection and tracking tasks within insurance imagery.

We provide polygonal labeling services, which involve outlining irregular shapes or areas of interest in images. When it comes to tasks like semantic segmentation and object delineation, this approach becomes an invaluable asset.

Our services include NER, where we identify and annotate specific named entities such as names, addresses, dates, and other relevant information within insurance documents. This helps extract structured data and streamline information retrieval.

We provide document classification services for insurance companies, wherein we analyze and categorize textual documents based on predefined categories for efficient document management, retrieval, and analysis.

We have experience in executing data collection projects where our team captures high-quality images of scratched and crashed cars. These images serve as valuable training data for tasks like damage assessment and claims processing in the insurance industry.

We employ image tagging techniques to assign relevant tags or labels to insurance-related images and categorize them. This helps in organizing and retrieving visual data efficiently.

Our team annotates images by drawing bounding boxes around specific objects or regions of interest. This technique aids in object detection and tracking tasks within insurance imagery.

We provide polygonal labeling services, which involve outlining irregular shapes or areas of interest in images. When it comes to tasks like semantic segmentation and object delineation, this approach becomes an invaluable asset.

Our services include NER, where we identify and annotate specific named entities such as names, addresses, dates, and other relevant information within insurance documents. This helps extract structured data and streamline information retrieval.

We provide document classification services for insurance companies, wherein we analyze and categorize textual documents based on predefined categories for efficient document management, retrieval, and analysis.

We have experience in executing data collection projects where our team captures high-quality images of scratched and crashed cars. These images serve as valuable training data for tasks like damage assessment and claims processing in the insurance industry.

Dedicated Team

We are a committed team of experts, essential for the specific insurance industry. If your project involves insurance documents, our team’s in-depth knowledge and consistent high-quality output will be a valuable asset to help you succeed.

Comprehensive Solutions

Our team offers a wide range of insurance data annotation services and expertise to provide you with complete solutions for your insurance workflow in AI. Whether it’s data annotation, collection, augmentation, data entry, and more, we’ve got all your data needs taken care of.

Certified Security

With sensitive customer information often contained in insurance documents, we adhere to enterprise-class security standards. Our dedication to security ensures your data is processed safely and confidentially, giving you peace of mind

Why Choose Data Annotation in Insurance at Label Your Data?

Our company holds certifications for PCI DSS (level 1) and ISO:27001, and we adhere to the regulations outlined by GDPR, CCPA, and HIPAA. With 10+ years of experience and 500+ specialists on board, we provide customized data labeling services in insurance for enterprise and R&D projects in 55 languages.

Our Success Stories

Insufficient labeled data for crashed car analysis.

On-street data collection by our specialists for a comprehensive labeling solution.

Data Annotation and Collection for Automated Car Damage Detection

The Bulgarian insurance company turned to Label Your Data for various tasks, including data annotation for crashed cars using bounding boxes and polygons. Our annotators were labeling damaged car parts and identifying their specific location on the vehicle. Additionally, when the client exhausted their image resources, they requested us to conduct data collection. For this purpose, two of our specialists were deployed to the streets to capture pictures of scratched and crashed cars, which were later annotated by our team.

Navigating legal clearances for sensitive data.

Secure data exchange via verified APIs with a dedicated team trained specifically for the project.

Data Annotation for Insurance Software Solutions Company

For a US-based Client, we tackled the task of annotation & labeling of data with highly specific industry tags, involving 10,000 insurance documents. Despite the legal clearances due to the sensitive and personal data within the documents, we successfully passed the security verification process and established a secure data exchange method using APIs. To ensure efficient collaboration, we formed a dedicated team, conducted joint workshops with the client, and crafted comprehensive and detailed instructions for the team’s seamless operation.

Enabling on-demand data tagging integration with diverse data flows.

A flexible workflow to trigger team involvement upon new data batches, ensuring seamless integration.

Image Tagging Services for the Insurance Company

We assisted an EU-based insurance company by tagging various images within their database. The challenge was seamlessly integrating our tagging and quality assurance processes into the client’s system. This on-demand project involves starting work as soon as a new batch of data becomes available, allowing flexibility in data flow without a constant commitment.

Start Free Pilot

fill up this form to send your pilot request

Thank you for contacting us!

We'll get back to you shortly

Label Your Data were genuinely interested in the success of my project, asked good questions, and were flexible in working in my proprietary software environment.

Kyle Hamilton

PhD Researcher at TU Dublin

Trusted by ML Professionals

Our Recent Articles

FAQs

What is the source of data in insurance companies?

The source of data in insurance companies includes customer information, policy details, claims history, underwriting data, and external data from various sources. The data enable insurance companies to enable well-informed choices and deliver pertinent services.

How does the insurance industry use data?

Insurance businesses use data to assess risk, underwrite policies, set premiums, detect fraud, improve customer service, and gain insights for their decision-making. Thus, data annotation in insurance plays a crucial role in enabling these specific advantages to insurance AI.

What is the importance of data annotation for insurance companies?

To start with, expert performed data annotation for the insurance industry turns data into a meaningful tool for companies wishing to integrate AI into their processes. Annotated data helps them improve the accuracy and reliability of ML models used for risk assessment, fraud detection, or customer service. Besides, automate labeling for insurance streamlines the process, enhancing efficiency and accuracy in risk assessment and claims handling.