Data Annotation Services in Finance with Security-First Approach

Through high-quality and secure finance data collection & annotation services, our team aims to enable innovative AI opportunities for fintech companies.

contact us

We Scale Teams for:

Data Annotation for FinTech at Label Your Data

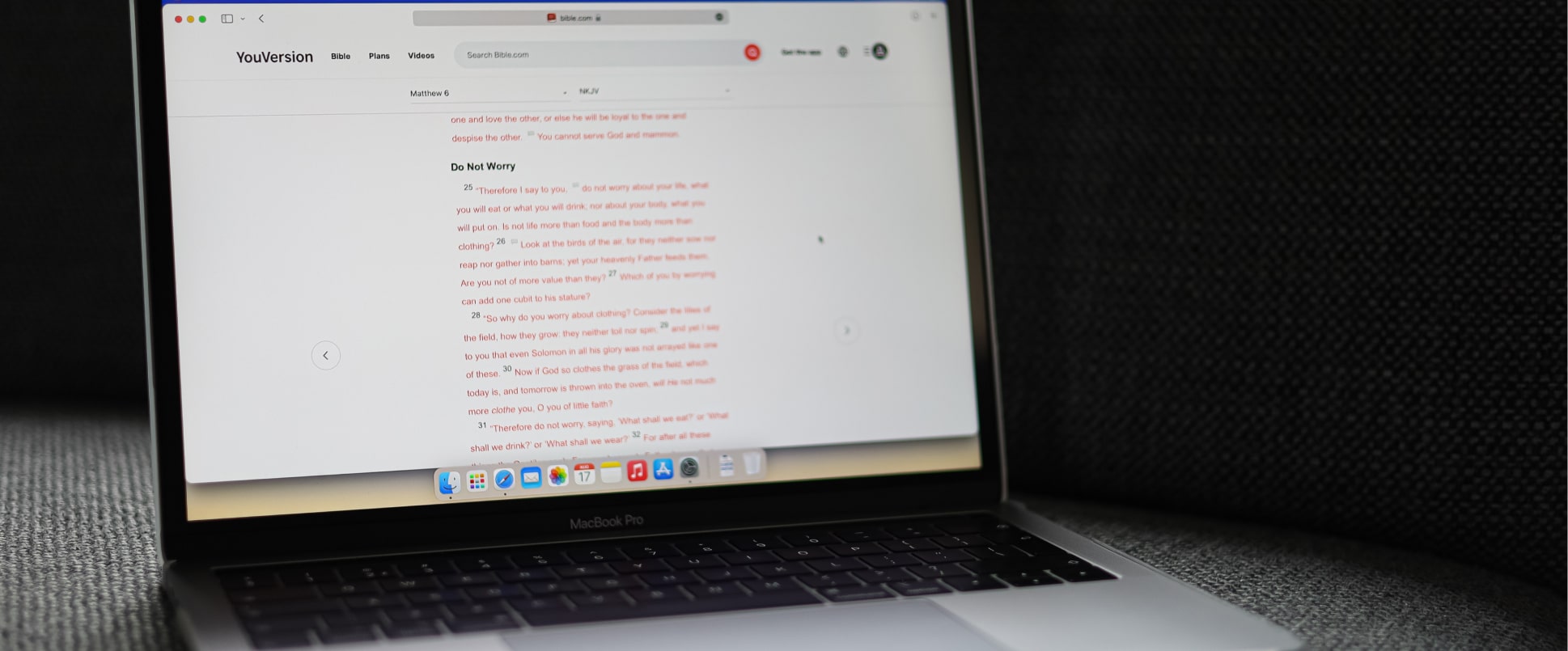

Our team has a keen eye for detail and a comprehensive grasp of financial concepts to help our clients excel in this highly specialized niche through machine learning-ready annotations. With a strictly professional and meticulous approach to data annotation in fintech, we provide custom datasets for banking or any specific financial use case to train ML algorithms for tasks like fraud detection, credit risk analysis, customer behavior prediction, and personalized financial recommendations.

Notably, we prioritize security by adhering to PCI DSS level 1 and ISO:27001 standards. We guarantee your financial data is in safe hands, ensuring the utmost confidentiality and protection throughout our data annotation in the financial industry. Rest assured, your sensitive information remains secure while we deliver custom financial and banking datasets tailored to elevate your fintech solutions.

Our Data Annotation Services for FinTech Companies

At Label Your Data, we offer comprehensive and secure data annotation for fintech services tailored specifically for this industry. Our skilled team of experts performs various critical tasks that help enhance the efficiency and accuracy of fintech applications through high-quality annotated datasets for ML model training:

A process for which we identify and classify essential entities in financial texts, such as names of people, organizations, currencies, or dates. This service helps our clients streamline data analysis and improve decision-making processes.

To enable easy access and retrieval of information, our annotators ensure that vast volumes of financial data are efficiently organized into relevant categories. Such a systematization simplifies complex data management, leading to better insights and optimized operations.

By crafting well-defined prompts and corresponding question-answer pairs, we facilitate the development of robust natural language processing (NLP) models, vital for seamless user interactions in fintech applications.

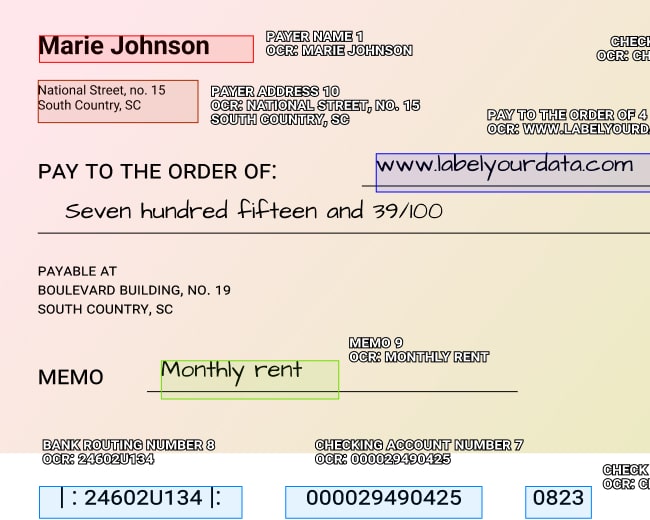

For this data annotation task in finance, we accurately extract valuable data from financial documents to expedite the digitization of crucial information, minimizing errors, and bolstering overall data-driven processes in finance.

A process for which we identify and classify essential entities in financial texts, such as names of people, organizations, currencies, or dates. This service helps our clients streamline data analysis and improve decision-making processes.

To enable easy access and retrieval of information, our annotators ensure that vast volumes of financial data are efficiently organized into relevant categories. Such a systematization simplifies complex data management, leading to better insights and optimized operations.

By crafting well-defined prompts and corresponding question-answer pairs, we facilitate the development of robust natural language processing (NLP) models, vital for seamless user interactions in fintech applications.

For this data annotation task in finance, we accurately extract valuable data from financial documents to expedite the digitization of crucial information, minimizing errors, and bolstering overall data-driven processes in finance.

Certified Data Protection

We prioritize stringent security measures and regulatory compliance. Unlike crowdsourced approaches, our dedicated teams are focused on providing the highest level of protection for your data. We can create isolated and secure network environments, guaranteeing enterprise-class security for your project.

Client Tool Integration

Our annotators are very flexible and can work with the clients’ tools, which is often requested due to high security requirements. With vast experience in most available instruments used for data annotation in fintech, we can easily integrate our teams and processes into any labeling tool that you already use.

Diverse Service Portfolio

Our extensive range of services sets us apart. Not limited to traditional data labeling services for fintech, we also excel in KYC procedures, data augmentation, Q&A prompt creation, data entry, and more. Our fintech clients have the freedom to request any of these services as per their requirements.

Why Choose Data Annotation in FinTech at Label Your Data?

Our company holds certifications for PCI DSS (level 1) and ISO:27001, and we adhere to the regulations outlined by GDPR, CCPA, and HIPAA. With 10+ years of experience and 500+ specialists on board, we provide customized data labeling services in FinTech for enterprise and R&D projects in55 languages.

Our Success Stories

Language barrier and sensitive data handling.

Seamless integration of bilingual data annotators into client’s secure infrastructure.

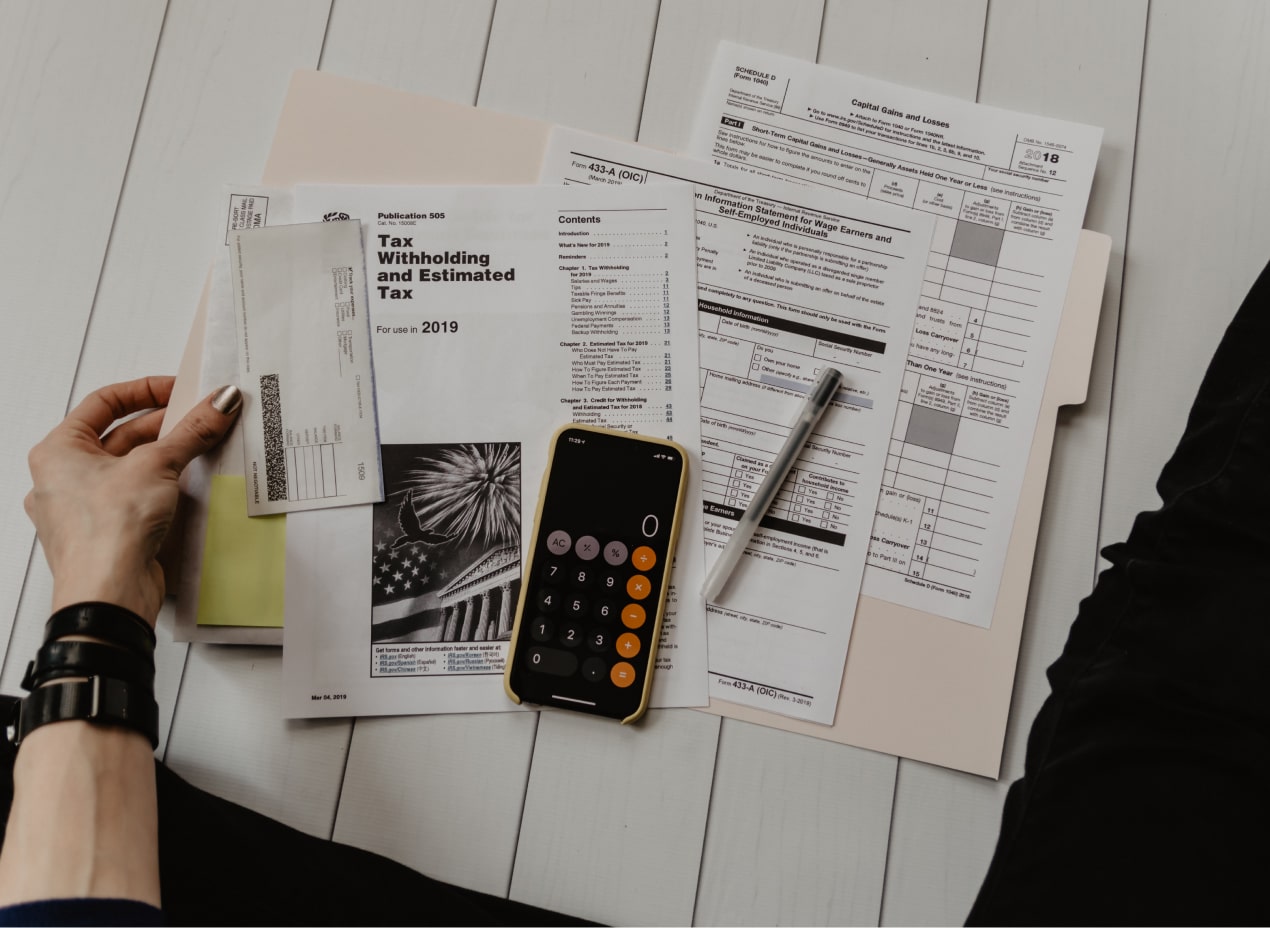

Secure Data Annotation for an Invoice Financing Company

As part of our data annotation for fintech services, we assisted a UK-based company offering online invoice financing services with their expansion into the Chinese market. We established a team of proficient data annotators fluent in both Chinese and English for this project. It involved processing sensitive data in multiple languages, including commercial invoices, shipment documents, and transaction details. To meet the client’s main requirement, we utilized their tool throughout the ongoing project to extract the required information.

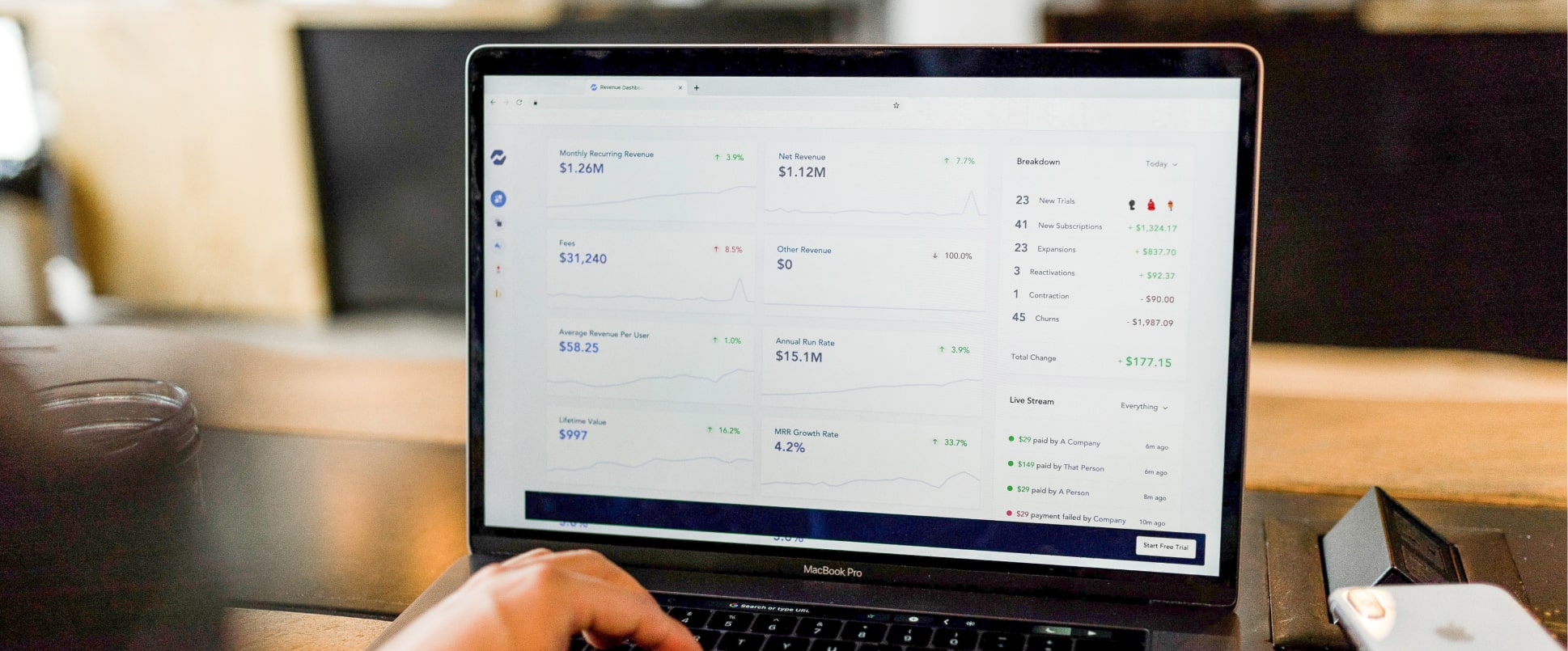

Managing high volumes of uncategorized data for seamless exchange.

Implementing API-based labeling for real-time transaction data management.

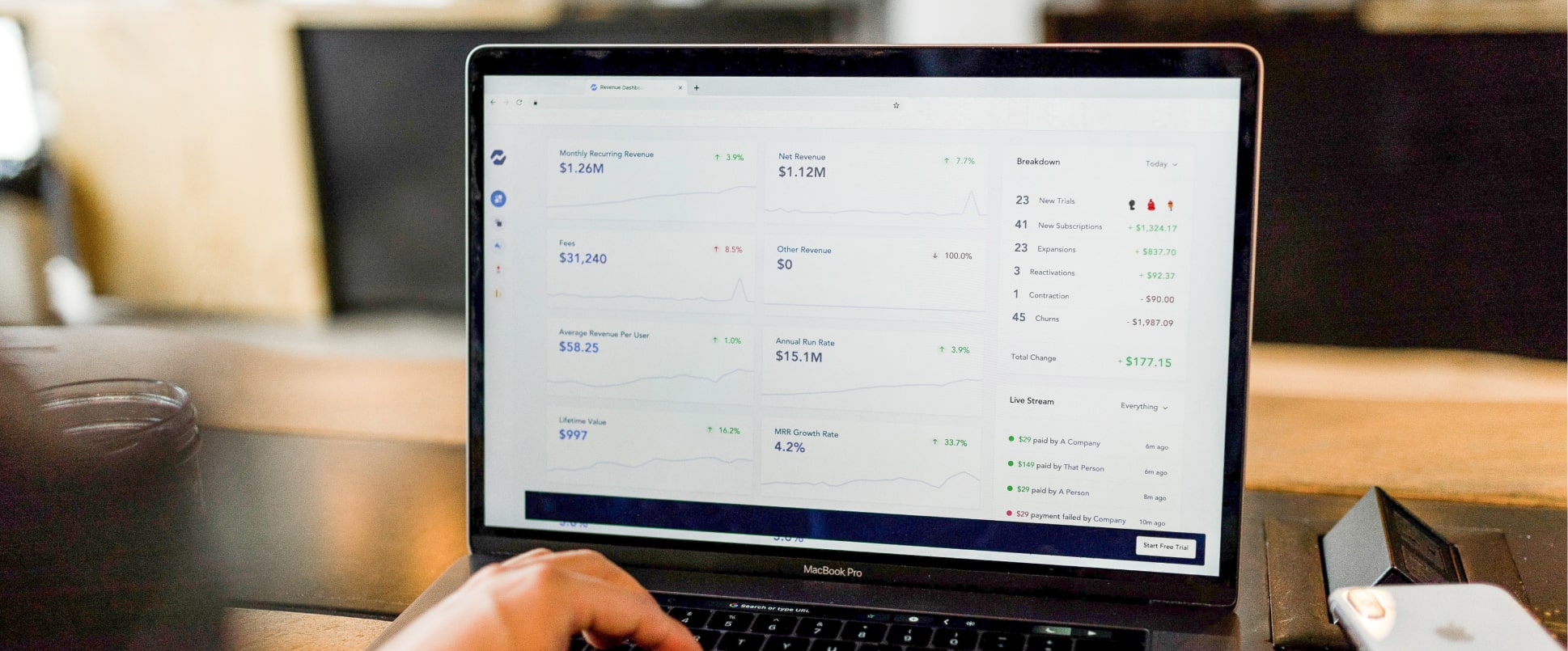

Data Processing for an Online Wallet Development Project

We worked with a UAE-based client to develop an efficient online wallet solution. As part of the project, we handled daily processing of uncategorized transactions. To streamline data exchange, we successfully integrated a live data labeling solution through an API. This ensured a seamless and smooth process for managing transaction data.

Dealing with high-volume unstructured transactions with tight deadlines.

Expert and timely team effort for efficient data annotation and processing.

Accelerated Data Processing for Crypto Transaction Analytics

Our team has efficiently handled a major project for our client, an Australian crypto company, by sorting 200,000 unstructured transactions within just three weeks. The urgency stemmed from a substantial backlog of transactions. Currently, we maintain an ongoing partnership, offering on-demand support as needed.

Start Free Pilot

fill up this form to send your pilot request

Thank you for contacting us!

We'll get back to you shortly

Label Your Data were genuinely interested in the success of my project, asked good questions, and were flexible in working in my proprietary software environment.

Kyle Hamilton

PhD Researcher at TU Dublin

Trusted by ML Professionals

Our Recent Articles

FAQs

Where can I find banking datasets to train an ML model for advanced financial analysis?

Some reliable sources to obtain comprehensive banking datasets include:

World Development Indicators (World Bank);

Federal Reserve Economic Data (FRED) (Federal Reserve Bank of St. Louis);

Statistical Data Warehouse (European Central Bank).

In addition, Label Your Data is your premier choice for expert and quality data annotation services for fintech, offering comprehensive banking datasets for analysis, ensuring accurate and reliable results in your financial endeavors.

What are the best practices for finance data collection to ensure accuracy and reliability in financial analysis?

To collect the right data in the banking industry, it is crucial to utilize reliable sources, implement robust data validation procedures, and adopt secure storage and transmission methods to ensure accurate and dependable financial analysis.

What are the main applications of custom datasets for banking in ML?

Custom financial datasets in ML have various applications, including credit risk assessment, fraud detection, customer segmentation, personalized marketing, and improving overall operational efficiency.