How Artificial Intelligence in Insurance Is Shaping New Trends?

There isn’t a single industry that hasn’t been transformed by artificial intelligence. The modern insurance sector is a striking example of how the industry can embrace and fully utilize AI to unlock new opportunities and keep abreast of technology trends.

AI is profoundly changing the insurance realm, thereby forcing the industry to adapt quickly to these changes. Insurers, consumers, financial intermediaries, brokers, and suppliers learn to become more adept at implementing advanced technologies in their work. Here, AI requires human workers to develop a special skill set and talent, embrace emerging technologies, and nurture an AI-oriented corporate culture.

With the right, fresh perspective on artificial intelligence in insurance, its current state can be elevated to new heights. In practice, this implies optimized customer experience, enhanced decision-making and productivity, and lower costs. Isn’t it something worth trying your hand at AI for? We at Label Your Data believe that it totally is!

In this article, we’ll review the most promising insurance AI solutions and discuss how the industry can prepare for the changing business landscape. A great deal of effort and deep technical knowledge from the team are required for a successful AI strategy in insurance. If you’re interested in learning more about how AI will affect insurance, keep reading!

Stepping Into The Era of Sophisticated Insurance Automation

Today, financial security is the choice of every knowledgeable person. The most common way to ensure that an individual is financially secure is to purchase insurance. This way, insurance eliminates financial uncertainty and reduces the impact of unintentional loss or mishap.

Given the power of automation, artificial intelligence and insurance turned into an advanced and tech-savvy realm with a much more efficient approach to risk management. Whether it’s property insurance, life insurance, health insurance, or vehicle insurance, AI has a wide choice of options for each:

- Better customer experience

- Enhanced decision-making

- Faster and more effective claims management

- Improved application processes

- Upgraded prospective healthcare advisory services

- On-demand insurance services

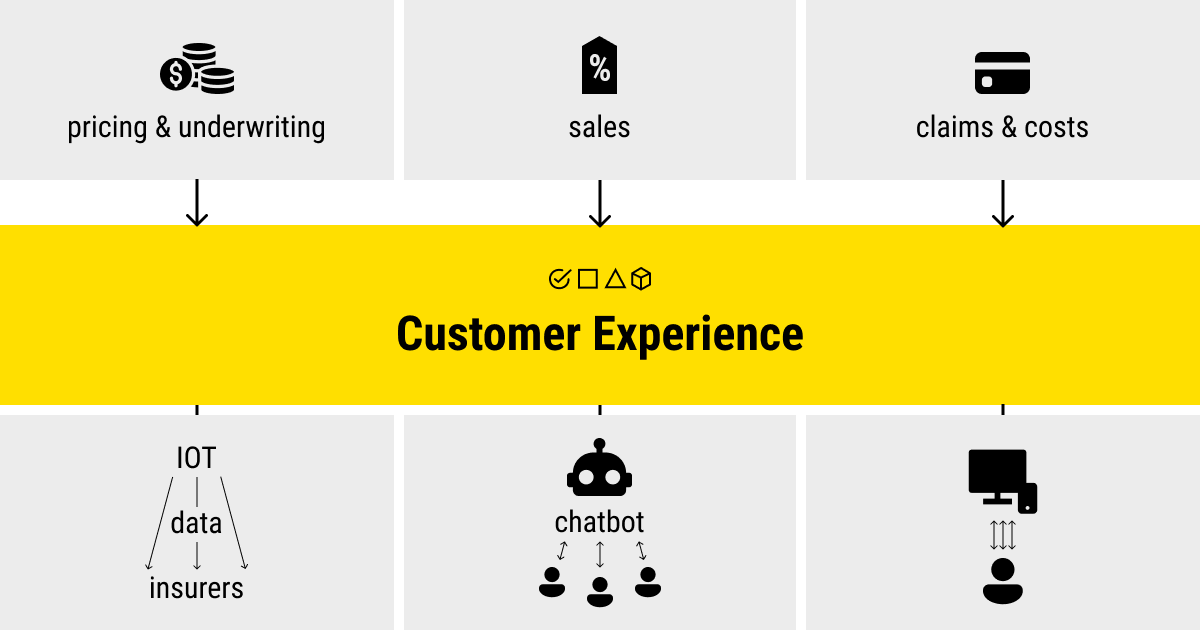

AI-driven transformation pays off in each sector within an overarching field of insurance, including pricing and underwriting, sales, as well as claims and costs. Sophisticated AI-powered technology is already applied to insurance via virtual chatbots and agents, fraud detection systems, and advanced solutions to calculate insurance risk. Let’s look at each of AI use cases in insurance in more detail:

Pricing & Underwriting

The use of AI in insurance underwriting and risk monitoring is the best way to streamline or even replace manual tasks like, for example, document reviews. Solutions like automation and advanced data analytics can be used to enhance the efficiency and accuracy of the pricing processes. Back-testing and model validation are more functional when using elaborate, real-time risk monitoring.

Sales

AI makes the sales processes simpler by providing various opportunities for emerging markets through digital and scalable channels. AI-driven solutions like advanced visual recognition and third-party app integration can be used to improve and expand distribution methods for every branch in the sector.

Claims & Costs

Artificial intelligence and insurance industry can do several useful things in the area of claims. Take for example new, accurate workflows that are responsive to customer needs. AI solutions here include automated response processes for claims adjudication and personal data administration. Advanced analytical models and external data can be applied to eliminate fraud and cut back on major expenses required for this process.

Thanks to AI, the partially or fully automated insurance industry has a chance to fix a lot of pressing issues and challenges. Eventually, it can become a progressive sector, harnessing the opportunities of state-of-the-art technologies.

Machine Learning Applications in Insurance

As a subset of artificial intelligence, machine learning is used to teach machines with data and let them learn from it to perform a given task. To give an accurate output, an ML model for insurance tasks requires labeled data and the right strategy to deploy it. And as you already know, ML is primarily concerned with pattern recognition and accurate results that are only possible with the right, secure data on hand.

Now, let’s see how ML works in the insurance industry!

— Tailored Insurance Advice

ML algorithms can review customer profiles and provide personalized product recommendations for the clients. Such machine-generated insurance advice is in high demand among customers of insurance firms. Insurers, in turn, can develop and implement chatbot technology using NLP services, this way resolving claim requests and answer client questions automatically.

— Claims Processing

ML solutions help insurers boost operational performance, including claims registration and claims settlement, and better understand claims costs. The key to proactive claim management lies in automation capabilities and predictive modeling enabled by machine learning. Automation is essential here since it can significantly enhance customer satisfaction, lower the claim settlement time, and save operational costs.

— Fraud Detection & Prevention

ML algorithms are well-known for accurately detecting fraudulent activity using unstructured and semi-structured data to identify potential fraud. It’s a fundamental cost-saving solution for the insurance companies that lose billions of dollars annually because of fraudulent claims.

— Advanced Risk Management

The predictive capabilities of ML models are necessary to predict premiums and losses for insurance policies. Early detection of risk allows insurers to make better use of the underwriter’s time, giving them a major competitive edge. ML algorithms for predictive analytics, in this case, require a large amount of data gathered from clients’ drivers to generate the best results for insurers.

— Customer Retention

In insurance settings, it’s much more affordable to retain a customer than to acquire a new one. However, this might be the case for every industry today. By adopting ML, insurers can understand their customers’ needs better and take proactive measures when needed, based on predictions of customer behavior.

— Property Analysis

Using data annotation in insurance, ML algorithms can be trained on labeled image data of a property (or damaged property) to accurately identify structures on it and different condition issues. This way, insurers can make the best decision when helping their clients with scheduling repairs or evaluating the cost of repair and the value of the damage.

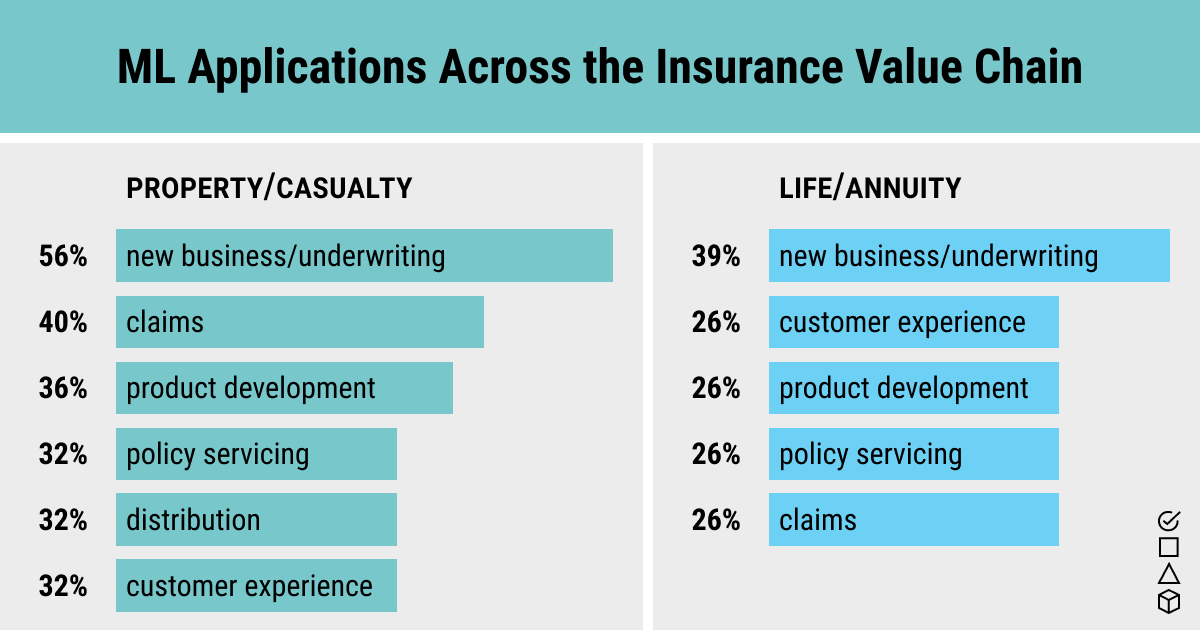

Machine learning proves to be a viable strategy for insurance organizations wishing to achieve better decision-making and streamline business processes. According to Accenture research, more than 90% of insurers either use or plan to use ML techniques for automating the claims or underwriting tasks.

AI applications in insurance go beyond the provided list of its current use cases in this industry. Today, insurers can leverage the full power of ML by applying its algorithms across direct marketing, customer experience, claims prediction, and audits for a modernized and scalable service.

AI Trends Shaping the Future of Insurance

Now that we’ve analyzed the current applications of machine learning in insurance, we must understand how these approaches will shape the future of insurance, fully led by AI.

- Data explosion from connected devices. The number of connected consumer devices is growing at breakneck speed. Equipment with sensors is widely used in insurance, causing a dynamic growth of new data. This data helps better understand insurance clients and contributes to the development of new product categories, personalized pricing, and real-time service delivery.

- Physical robotics. Past generations were perplexed by the emergence of robots in their lives. Today, robotic technology is unlikely to surprise anyone. Robots have changed how humans interact with the environment with the introduction of automotive vehicles, additive manufacturing, surgical robots, etc. Altogether, they pose new risks across industries, enabling new products and channels in insurance.

- Open-source and data ecosystems. Data is everywhere. It’s shared and used across multiple industries. However, data requires new ecosystems so that it can be shared under a common regulatory and cybersecurity framework.

- Cognitive technologies. Convolutional neural networks and other deep learning solutions are becoming more ubiquitous in insurance to process large volumes of complex data. This data is closely linked to an individual’s behavior and activities and can, therefore, provide new engagement techniques responsive to the underlying risks of customer behaviors in real-time.

How can insurers prepare for the future AI-led business environment? First, they can learn more about artificial intelligence in insurance, as well as related trends and technologies to increase their knowledge of the innovation in the industry. After that, it’ll be easier for tech-savvy insurers to develop and integrate a coherent strategic plan in practice. This requires a robust data strategy supported by the right talent pool and technology infrastructure.

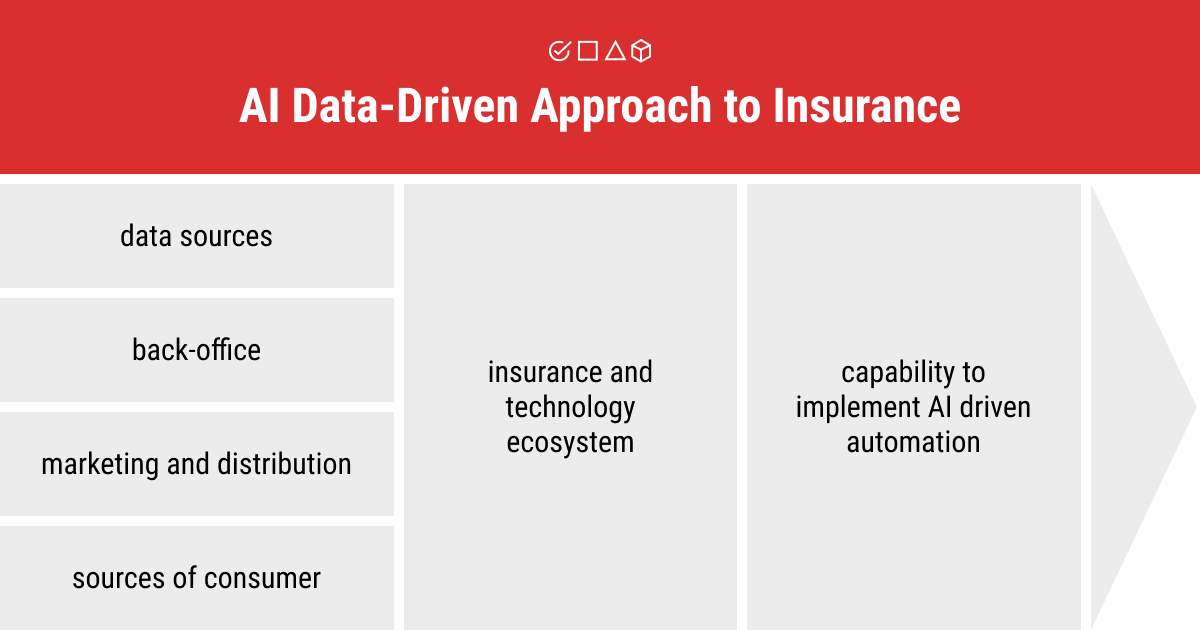

How Do Companies Use Insurance Data and Why?

Let’s start with the importance of data in today’s insurance industry and why businesses must learn how to use it correctly. Insurance data is the big data used for insurance purposes. It involves both unstructured (unconventional data from social media, written reports, or wearable technologies) and structured data (tables, databases, spreadsheets) that can be useful for impacting underwriting, pricing, rating, marketing, and claims management processes.

To better understand and regulate customer relationships, claims, and underwriting, insurance companies are gathering data from telematics, agent contacts, client interactions, smart homes, as well as social media. They do so either manually or using automated data collection. Accurate client data help them establish the most detailed and effective policies and pricing. Additionally, data visualization for insurance brokers is simplified. In principle, this means that policies will grow more cost-effective over time. It will also have no negative impact on the insurance company’s image.

AI in insurance data are used by a number of insurance companies to strengthen policy coverage and customer experience. Some of them include:

- Lemonade

- State Farm

- Allianz Travel Insurance

- John Hancock International

- MetroMile

- Safeco

- Blue Cross Blue Shield

- Vitality

Label Your Data & Insurance Data

In our practice, we had several interesting use cases of big data for insurance purposes. Our skilled team of data annotators at Label Your Data has worked with three different insurance companies, which specialized in auto insurance claims. The goal was to annotate images of damaged cars in bounding boxes and polygons, and label them according to the level of damage (i.e., heavy, light, and medium damage) and its location on the car. These datasets were further used to train an ML algorithm to detect the level of car damage and compensation for it.

Thus, our expert image annotation services and professionally built ML algorithm helped create the model that could detect car damages and automatically determine the amount of compensation for such incidents. The coordinated work of the annotation team and the insurance company turned out to be fundamental to the successful adoption of artificial intelligence for insurance.

Let’s Recap: How Is AI Unleashing the Power of Data in the Insurance World?

We all have something to lose, and there is no better way to protect ourselves than by purchasing insurance. Yet, when measuring AI impact in insurance, how much can we trust it to deal with our finances or life? Is this an all-or-nothing decision to make?

AI will cause significant disruption in the insurance sector during the next decade, whether we like it or not. We at Label Your Data are positive about the rapid integration of artificial intelligence in insurance, given that new technologies give rise to innovative products, new data sources, improved operational processes and lowered costs. As a result, insurance firms reap the benefits of AI by exceeding customer expectations and providing them with the most personalized experience possible.

Above all, insurers have a chance to develop a digitally-oriented mindset and discover the many opportunities that modern technologies provide. Indeed, AI is the wave of the future in almost every industry.

FAQ

What is the best use of AI in insurance?

While AI brings numerous benefits in the field of insurance, one of its most important application is risk management. This involves leveraging ML algorithms to analyze vast datasets, identify patterns, and proactively assess and mitigate risks. They include underwriting, claims, fraud, operational efficiency, market dynamics, catastrophic events, and customer retention.

What is an example of AI in insurance?

AI is making a difference in insurance by assisting companies in various ways, such as helping auto insurers or other small businesses evaluate real-time driving behavior to potentially reward safe drivers with discounts.

How to annotate insurance data for AI?

Depending on the type of data and the task at hand, one can deploy various data annotation techniques for insurance data. For example, you may use named entity recognition (NER) to label entities such as policy numbers, dates, and beneficiary names. Sentiment analysis may come in handy for claim descriptions. Also, you can apply image annotation techniques for damage assessment photos in claims processing.

Written by

Karyna is the CEO of Label Your Data, a company specializing in data labeling solutions for machine learning projects. With a strong background in machine learning, she frequently collaborates with editors to share her expertise through articles, whitepapers, and presentations.